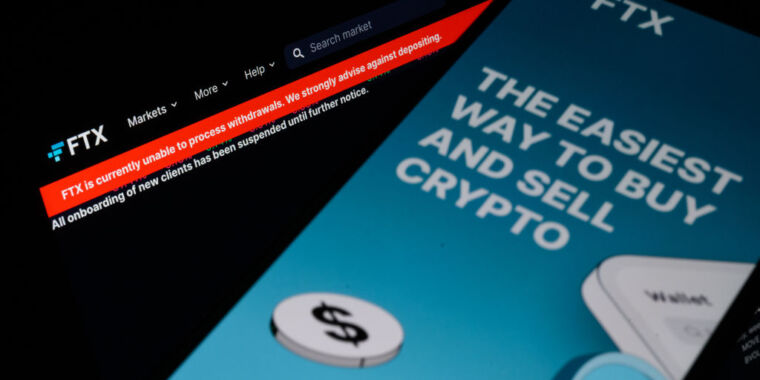

Can you un-legalese this?

I will need some time, but this is just beyond words. This is a statement of the guy put to replace SBF during Chapter 11. He did Enron’s proceedings.

He says in thsi document (not a court judgment, only his opinion, but still):

1. No corporate governance at all - no board meetings.

2. No cash management - they don’t have a system saying where the companies have accounts and who has access to these accounts

3. No audited financials - the books aren’t reviewed by an audit firm and cannot be relied upon. The books that have been reviewed are still unreliable.

4. No HR clear lines - they don’t even have a full list of employees.

This is before even going into the fact that there is a several-billion dollars sized hole in their balance sheet and they are utterly insolvent.

I mean, there is this paragraph also:

«

The Debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise. For example, employees of the FTX Group submitted payment requests through an on-line ‘chat’ platform where a disparate group of supervisors approved disbursements by responding with personalized emojis.

63. In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas. »

You… this is just - there is a level of bluntness here that I cannot describe. It’s all like this.

This is the openinh paragraph, ffs:

«

I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron). I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources and systems integrity.

5. Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented. »

kotaku.com

kotaku.com

kotaku.com

kotaku.com